What is a Foreign-Trade Zone?

A foreign-trade zone is a designated location in the United States where companies can use special procedures that help encourage U.S. activity and value added – in competition with foreign alternatives – by allowing delayed or reduced duty payments on foreign merchandise, as well as other savings.

A site which has been granted zone status may not be used for zone activity until the site has been separately approved for FTZ activation by local U.S. Customs and Border Protection (CBP) officials, and the zone activity remains under the supervision of CBP. FTZ sites and facilities remain within the jurisdiction of local, state or federal governments or agencies.

What are the Benefits of Operating in a Foreign-Trade Zone?

The growth in global trade and the need to level the competitive playing field on taxes has accelerated the use of trade zones. The FTZ program allows U.S.-based companies to defer, reduce or even eliminate Customs duties on products admitted to the zone, providing important benefits to businesses and industries. Some of the benefits include:

- Duty deferral

- Duty elimination

- Duty reduction

- Federal and state tax savings

- Transfers between zones with no duties

- Reduced paperwork

- Destruction of damaged or substandard goods without paying duties

NC FTZ 214

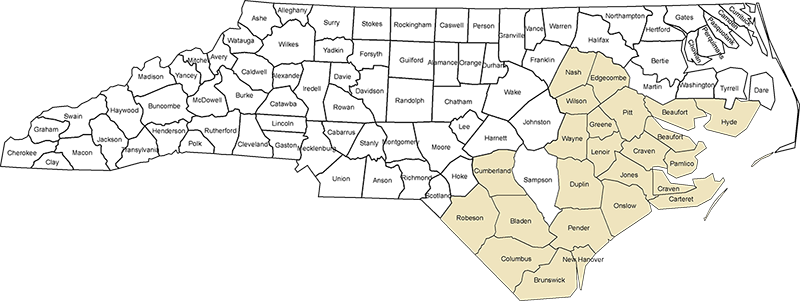

There are 22 counties that comprise this Foreign Trade Zone and the FTPC will be your go- to resource for all things FTZ and ASF. This is one of 4 trade zones in NC and utilization of these zones provides tax advantages for import/export businesses. Let us help you get started!